How to diligence operational forecasts

Here is a great post from Alexsey Chernobelskiy, with some guidelines for LPs in real estate.

I agree with the thrust of what Alexei wrote. In particular:

Fees are zero sum, so if GP fees are well above market, LP returns will suffer. This isn’t a lesson in business ethics, it’s a lesson in math.

Generally speaking, LPs should assume that a fundraising deck is a sales pitch, not a neutral analysis of the facts. Caveat Investor.

But as an experienced GP who underwrites deals for a living—and looks at other sponsors’ fundraising decks as a hobby, I have something to add.

A good way for an LP to protect herself—and to suss out whether the GP is reliable—is to pressure test the deal’s assumptions.

Obviously, an LP cannot be expected to re-underwrite an entire deal. However, there are a few really important topics which an LP can focus on without too much work.

In this post, I will emphasize the operating forecasts, as opposed to the financing assumptions or exit cap rates, although those are important too.

Here are the 4 most important operational diligence questions I think an LP should ask, in descending order of importance.

Are the rents believable?

Are the property taxes believable?

Are the insurance expenses believable?

Are the other operating expenses believable?

Are the rents believable?

This is the single most important driver of investment returns, and nothing else comes close. A real estate investment is, at bottom, a highly levered bet on rents. If a sponsor expects to achieve $1,000 rents but actually achieves $900 rents, disaster will ensue. For example, if operating expenses are $700 per month, this isn’t just a 10% miss on revenue, ($100/ $1,000), it’s a 33% miss on net operating income ($100 / $300). This could easily be the difference between hitting projected returns and a total wipe out.

So if there’s anything an LP is going to diligence, it should be this.

Here are some straightforward questions to ask.

a. What are the market rents for each unit type?

b. What rents did the previous owner get on recent move ins?

c. What rents are comparable properties getting on similar units? (Comparable means: similar vintage, similar size, similar amenities, nearby location in similar neighborhood)

For question 1b, LPs will rarely have access to the seller’s rent roll, though some GPs will share this information.

But for question 1c, it is not very hard for an LP to do their own diligence on comparable properties. For multifamily investments, this can be readily obtained from apartments.com, or potentially a google search.

For asset classes other than multifamily, I’m not sure how best to sanity check. But if I were an LP, it’s the main thing I would want to figure out.

Are the property taxes believable?

This topic can get very complicated very quickly, because every state is different.

But it’s extremely important, because investors can—and do—get wiped out by making mistakes on this. For example, let’s suppose a property was bought in 2015 by the previous owner for $20 million, and was still being taxed at 2.0% of that, or $400,000. If the new owner is purchasing for $50 million, and and will begin paying taxes of 2.0% of that ($1,000,000), that is a very substantial increase of $600,000.

If the GP is failing to account for this, it can be devastating.

It may surprise people to know that GPs make this mistake, but they do. I have seen it happen. There are many reasons for this, but a simple one is: most brokers do not go out of their way to explain this phenomenon to buyers, and indeed some of them will actively mislead.

Here is a simple set of questions an LP can ask to protect themselves:

a. What is the “year 1” property taxes divided by the purchase price?

b. What is the statutory tax rate in the relevant jurisdiction?

c. If a and b are different, why is that, specifically? Has the GP sought advice of experienced local tax counsel? Has the GP bought in this jurisdiction before?

Are the insurance rates believable?

This is more important in some states than others. Insurance rates are skyrocketing in locations which are i) subject to heightened climate risk, or ii) subject to increasing insurance litigation.

For example, this matters a lot more in Texas or Florida than it does in Ohio.

a. Has the sponsor gotten a quote from an insurance carrier? Which one?

b. What are the pro forma costs per unit? As a percent of purchase price? As a percent of replacement cost?

Of these questions, 3a is more relevant than 3b, particularly to an LP who is not active in the markets.

Are the operating expenses believable?

There are four major categories of operating expenses:

Property Taxes

Insurance

Utilities

Everything else

Property taxes and insurance I’ve already covered.

Utilities

For utilities, there are two sanity checks to make:

Are the pro forma expenses less than the trailing expenses + inflation? If so, why?

What are the pro forma expenses per unit? How does this compare to ‘normal’, given the unit size? An LP probably won’t know what is normal, but a GP should know and be willing to share.

Everything else

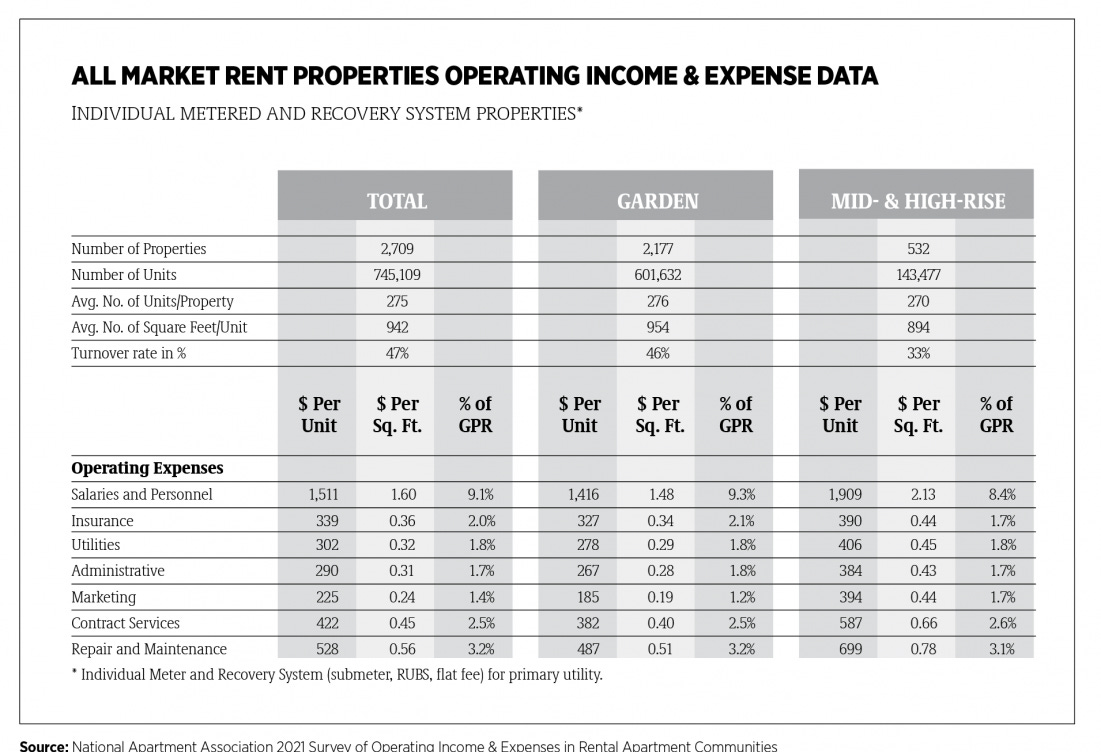

“Everything else” contains multitudes, and it can seem overwhelming but it does not take much to sanity check things. The best way to do this is to look at expenses per unit (or per square foot), broken down into high level categories, and compare with benchmarks.

Up until 2021, the National Apartment Association (NAA) published a free summary of survey data on this topic. The data is still available post 2021, but at a cost.

Link: NAA Operating Expense Survey

Here is the 2021 summary data:

This is national data, and it is from 2021. Due to local market conditions, property characteristics and general inflation, nobody should expect a property to fall perfectly in line with these benchmarks.

But if a property’s pro forma shows expenses which are way out of line with these, it is worth digging in.